Why is eth dumping post merge?

The question on everyone’s mind. The merge was successful, the new ecosystem is running smoothly. Supply is decreasing. So why is the price dropping?

As usual with crypto, there is no concrete answer. But we can go through a couple of theories.

Macro Picture

The first and most clear reason is the current macro picture. Looking at the upcoming worries of a recession, increasing interest rates, a dropping stock market, and a crypto bear period. It is not unexpected that $ETH would drop along with all other cryptocurrencies.

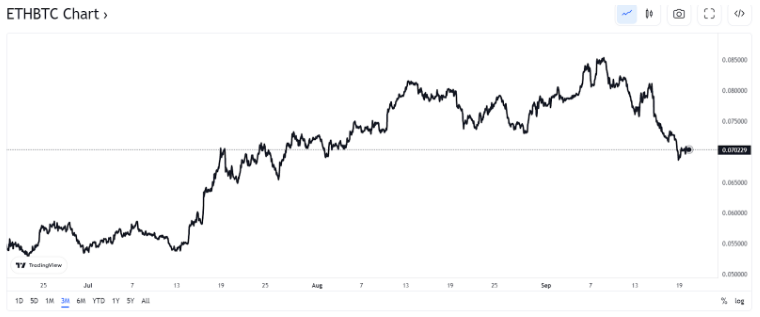

$ETH performed well in the weeks leading up to the merge, with its price up around 20% more than bitcoin in early September. This was likely due to the hype leading up to the merge. All other crypto were dropping, but $ETH was holding strong. This meant that the drop we are seeing now could actually be explained by a delayed effect of the market conditions. Looking at the $ETH/$BTC chart supports this as well.

Misinformation

Another potential reason for the drop could be due to the spread of misinformation before the $ETH merge. Posts on twitter were claiming that the merge would lead to lower gas fees, faster transactions, and much more. According to the official $ETH website, this was never expected to happen. The main reason for the merge was to reduce the energy consumption of the blockchain.

It is possible that people bought into $ETH based on the misinformation and were disappointed to find out that it was not the case. This could have led them to dumping their $ETH back into the market.

Miners are Dumping

A less talked about theory is that $ETH miners are dumping their holdings. The $ETH merge was met with outrage from the mining community. Their stable earnings have now been replaced with earnings spread more equitably across stakers.

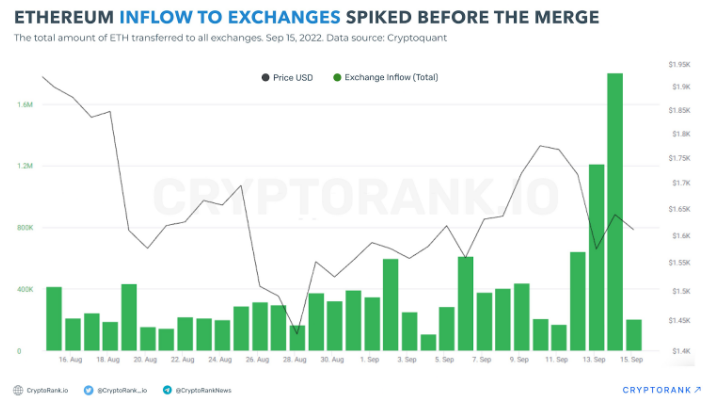

Miners have created ETHPoW to be able to continue running their money machines, but ETHPoW has dumped by around 55%. So it is clear that their mining machines are not providing a stable and reliable income. This could have led to the miners needing to sell off more $ETH to cover their costs and keep their income in fiat stable. Looking at the influx of $ETH to exchanges backs this.

The Bottom Line

Don’t worry. The merge went well. Around 11% of eth is staked. Eth has become deflationary. And the blockchain is using 99.98% less electricity, making it a more environmentally friendly cryptocurrency and more future proof.

This is all very good news for the cryptocurrency space. Stick to your personal investing strategies, do not let yourself be influenced by FUD and never risk more than you can afford losing.

About Making Cents

Making Cents is a community-driven marketing, education and social platform on the VITE network. Get weekly highlights in the cryptocurrency space by following us on our socials!

Twitter: https://twitter.com/BeMakingCents

Discord: https://discord.gg/XkNPut8eNT

Publish0x: https://www.publish0x.com/@MakingCents

Wortheum: https://wortheum.news/@makingcents/